➤Summary

Global Life Insurance data breach reports surfaced after a massive dataset allegedly appeared for sale on BreachForums.st, drawing immediate attention from cybersecurity analysts and identity protection experts. According to the forum post, the leak contains 856,857 records with highly sensitive personal and insurance-related information, including SSNs, dates of birth, and full life insurance policy details 😨. The author, operating under the alias BitIcon, claims the database originates from Global Life Insurance USA and is being offered for sale in bulk or retail portions. This incident highlights the growing risks tied to exposed financial and identity data and underscores why proactive monitoring is no longer optional. Below, we break down what was leaked, why it matters, who is at risk, and what defensive steps organizations and individuals should take immediately 🔍.

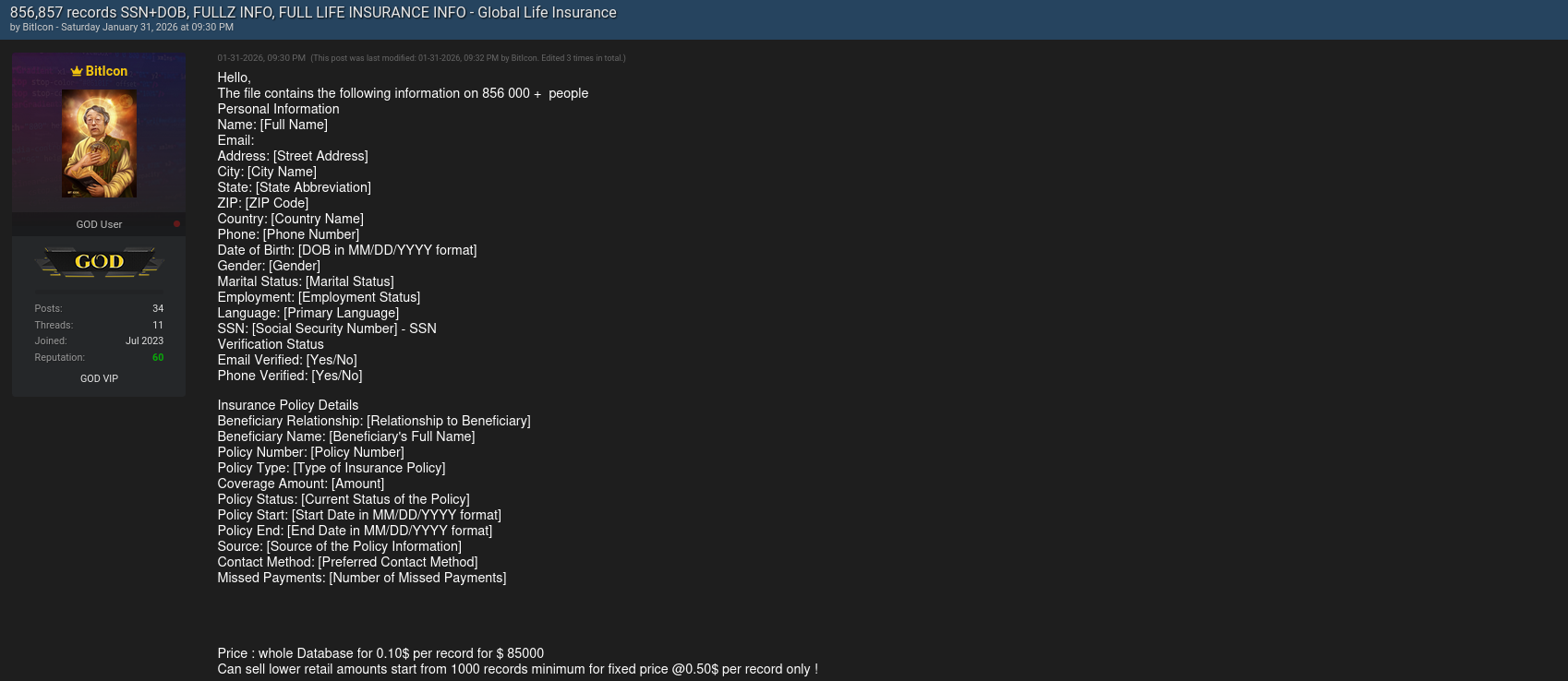

What Happened in the Global Life Insurance Data Breach

The Global Life Insurance data breach was advertised on BreachForums.st with a publication date of 31 January 2026. The seller claims possession of nearly 857,000 unique records tied to U.S.-based insurance customers. The database is allegedly “fresh,” well-structured, and intended for fraud-oriented use cases, which dramatically increases its threat level 🚨. The leak status is marked for sale, with pricing set at $0.10 per record for the entire dataset—approximately $85,000—or smaller retail bundles starting from 1,000 records at $0.50 per record.

Types of Compromised Personal Information

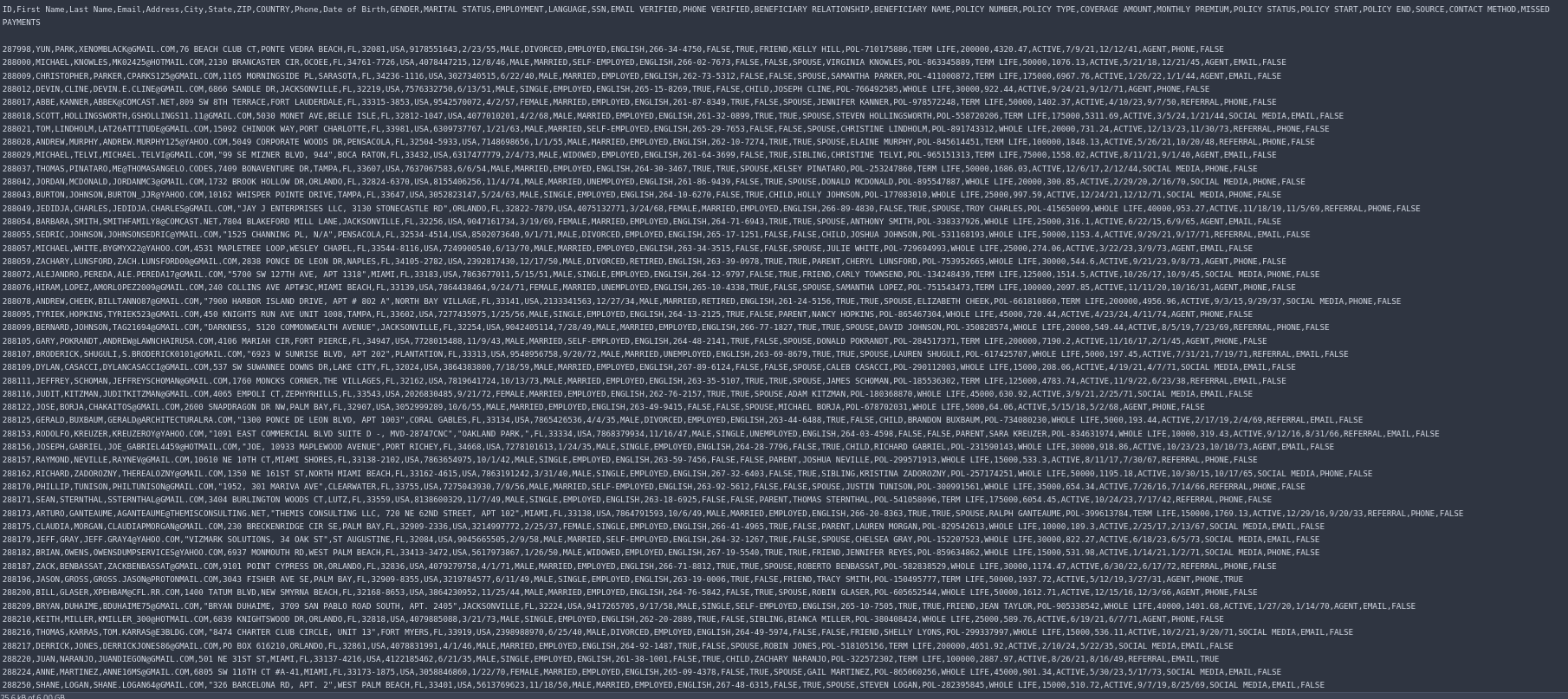

Based on the forum listing, the exposed data goes far beyond basic contact details. The dataset allegedly includes:

- Full name, email, phone number, and physical address

- City, state, ZIP code, and country

- Date of birth and gender

- Marital status, employment status, and primary language

- Social Security Number (SSN)

- Email and phone verification status

This depth of personal information makes the Global Life Insurance data breach particularly dangerous, as it enables high-confidence identity theft and account takeover schemes 💣.

Exposure of Full Life Insurance Policy Details

What elevates this incident further is the inclusion of complete insurance policy information. The compromised dataset reportedly contains:

- Policy number and policy type

- Coverage amount and policy status

- Policy start and end dates

- Beneficiary name and relationship

- Missed payments history and preferred contact method

Insurance fraud experts note that such detailed policy data can be exploited for fraudulent claims, beneficiary manipulation, or targeted social engineering attacks 😬.

Why “FULLZ” Data Increases Criminal Value

In underground markets, “FULLZ” refers to complete identity profiles containing SSN, DOB, and supporting personal data. The Global Life Insurance data breach qualifies as FULLZ-level exposure, which significantly raises resale value and criminal utility. FULLZ data enables attackers to bypass KYC checks, open financial accounts, and conduct long-term fraud with minimal resistance. This is why insurance-related breaches often have longer-lasting impacts than retail or login-only leaks.

Who Is Most at Risk from This Leak

Individuals whose data appears in the alleged Global Life Insurance dataset face elevated risks of:

- Identity theft and synthetic identity fraud

- Insurance policy fraud or unauthorized changes

- Tax fraud using SSN and DOB

- Targeted phishing and impersonation scams

Organizations are also at risk, as leaked insurance data can be used to craft convincing B2B fraud scenarios or extortion attempts 😓.

Dark Web Context and Threat Intelligence

The appearance of this dataset on BreachForums.st aligns with a broader trend of monetizing insurance and healthcare-related data on underground forums. Analysts tracking similar incidents emphasize the importance of dark web monitoring to identify early exposure signals. Leveraging dark web monitoring reports helps security teams confirm whether leaked records are actively traded or weaponized. A unified dark web solution can correlate breach intelligence with exposed assets, while Dark Web Monitoring for MSSP providers enables scalable protection for multiple clients and industries 🌐.

One Critical Question: Is This Data Actively Being Misused?

Yes. When data is listed for sale rather than dumped publicly, it usually indicates intent for targeted misuse. Buyers often include fraud rings and identity brokers, making the Global Life Insurance data breach an active and evolving threat rather than a static incident.

Practical Checklist: What Affected Individuals Should Do

If you suspect exposure, follow this checklist immediately:

- Place a fraud alert or credit freeze with major bureaus

- Monitor insurance statements for unauthorized changes

- Be alert to phishing emails referencing insurance details

- Avoid sharing verification codes or SSN fragments

- Consider identity theft protection services ✅

Security experts often stress that early action can significantly reduce long-term damage.

Organizational Impact and Defensive Measures

For insurers and partners, the Global Life Insurance data breach highlights gaps in data protection, access controls, or third-party risk management. Organizations should:

- Audit data storage and access logs

- Review vendor security posture

- Enhance monitoring of exposed credentials

- Align breach response with regulatory obligations

Expert Insight on Insurance Data Breaches

“Insurance data is uniquely dangerous because it combines identity, financial, and long-term contractual information,” notes a senior analyst at a U.S. cybersecurity research firm. “Once leaked, it can be exploited repeatedly over years, not weeks.” This perspective underscores why incidents like the Global Life Insurance data breach demand sustained attention, not one-time alerts.

External Guidance on Identity Protection

For authoritative consumer guidance on identity theft response, the U.S. Federal Trade Commission provides comprehensive steps and resources . Such guidance complements threat intelligence by helping victims take concrete recovery actions 📘.

Conclusion: Why This Breach Demands Immediate Attention

The Global Life Insurance data breach is not just another forum post—it represents a high-risk exposure of nearly 857,000 individuals with FULLZ-level data and detailed insurance records. The combination of SSN, DOB, and policy information creates a perfect storm for fraud, impersonation, and long-term identity abuse 🔥. Staying informed, monitoring underground activity, and acting quickly are essential for minimizing damage.

Discover much more in our complete guide

Request a demo NOW

Your data might already be exposed. Most companies find out too late. Let ’s change that. Trusted by 100+ security teams.

🚀Ask for a demo NOW →Q: What is dark web monitoring?

A: Dark web monitoring is the process of tracking your organization’s data on hidden networks to detect leaked or stolen information such as passwords, credentials, or sensitive files shared by cybercriminals.

Q: How does dark web monitoring work?

A: Dark web monitoring works by scanning hidden sites and forums in real time to detect mentions of your data, credentials, or company information before cybercriminals can exploit them.

Q: Why use dark web monitoring?

A: Because it alerts you early when your data appears on the dark web, helping prevent breaches, fraud, and reputational damage before they escalate.

Q: Who needs dark web monitoring services?

A: MSSP and any organization that handles sensitive data, valuable assets, or customer information from small businesses to large enterprises benefits from dark web monitoring.

Q: What does it mean if your information is on the dark web?

A: It means your personal or company data has been exposed or stolen and could be used for fraud, identity theft, or unauthorized access immediate action is needed to protect yourself.

Q: What types of data breach information can dark web monitoring detect?

A: Dark web monitoring can detect data breach information such as leaked credentials, email addresses, passwords, database dumps, API keys, source code, financial data, and other sensitive information exposed on underground forums, marketplaces, and paste sites.